A Comprehensive Guide to Opening a Bank Account with Sparkasse

Opening a bank account with Sparkasse is a crucial step towards managing your finances effectively in Germany. Sparkasse is a prominent and trusted banking institution with a wide range of account options tailored to suit various needs. In this detailed guide, we will walk you through the process of opening a bank account with Sparkasse, ensuring a smooth and hassle-free experience.

Step 1: Research and Choose the Right Account Type:

The first step in opening a bank account with Sparkasse is to determine which account type best fits your requirements. Sparkasse offers various accounts, including:

- Girokonto (Checking Account): Ideal for daily transactions, bill payments, and receiving your salary.

- Savings Account: For saving and earning interest on your money.

- Youth Account: Designed for young individuals under 25, often with special benefits.

- Business Account: Tailored for entrepreneurs and business owners.

- Online Account: A digital option for those who prefer online banking.

Research these options, considering factors such as fees, features, and your financial goals, to choose the most suitable account type.

Step 2: Gather the Necessary Documentation:

Before visiting a Sparkasse branch, ensure you have all the required documents:

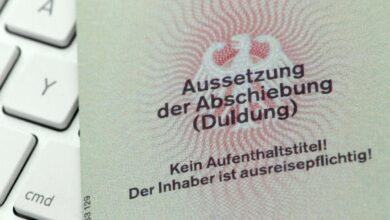

- Valid Passport or ID: A government-issued photo ID, such as your passport or national ID card.

- Proof of Address: A document confirming your current address, like a utility bill or rental agreement.

- Proof of Income: For certain accounts, you may need to provide proof of income, such as pay stubs or employment contracts.

Make sure to have both physical copies and photocopies of these documents.

Step 3: Visit a Sparkasse Branch:

To open your account, you’ll need to visit a nearby Sparkasse branch in person. Schedule an appointment in advance if possible to minimize waiting times.

Step 4: Complete the Application:

Upon arrival at the Sparkasse branch, you will be provided with an application form. Fill it out accurately and attach all necessary documents. If you have any questions or need assistance, don’t hesitate to ask the bank representative for guidance.

Step 5: Deposit an Initial Amount:

Some Sparkasse accounts may require an initial deposit, while others may not. Be prepared to make this deposit if necessary.

Step 6: Receive Your Account Information:

Once your application is processed and approved, you will receive your account information, including your account number and IBAN. You’ll also receive your banking card (usually a debit card) and PIN.

Step 7: Activate Online Banking (Optional):

If you wish to use online banking, Sparkasse offers this service. You will need to activate it separately, and the bank representative can assist you with the setup.

Opening a bank account with Sparkasse is a straightforward process, but it’s essential to choose the right account type and have the necessary documentation ready. By following these steps, you’ll be well-prepared to start managing your finances effectively with Sparkasse.